Car Loan Apr Chart

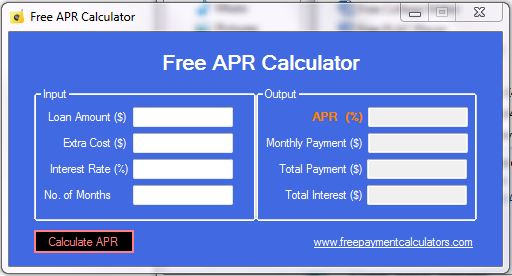

You can also create a custom amortization schedule for loan principal interest payments.

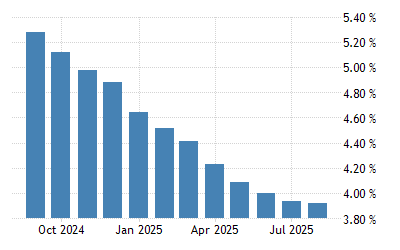

Car loan apr chart. The interest rate on the other hand reflects only the annual cost of borrowing the money no fees included. Rates as of june 2019 from myfico and. When comparing loans the consumer financial protection bureau suggests looking at aprs versus interest rates. A car loans apr is the cost youll pay to borrow money each year expressed as a percentage.

Check out bankrates current car loan interest rates for the most up to date average aprs. The advanced apr calculator finds the effective annual percentage rate apr for a loan fixed mortgage car loan etc allowing you to specify interest compounding and payment frequencies. Then well show your likely repayments based on a low moderate and high apr. The type of car you are interested in also affects the apr for a car loan.

The basic scale for credit scores is. It includes not only the interest rate on the loan but also certain fees. Three different credit reporting agencies keep track of consumer credit scores experian transunion and equifax and your score from each might differ slightly because. Input loan amount interest rate number of payments and financing fees to find the apr for the loan.

Amortization calculations also use the type of. Auto loans apr as low as. This car finance calculator shows you what your monthly repayments are likely to be based on your loan amount. Car amortization schedule uses inputs like down payment amount loan term and interest rate to help identify exactly what your car payments are or will be.

Rates accurate as of oct. Laws of different countries ask the loan providers to specify the apr to every loan borrower. Apr 720 850 3719 690 719 5071 660 689 7139 620 659 9882 590 619 14135 500 589 15297. Just select how much you want to borrow and how long you want the agreement to last.

This should give you a good idea of the finance options available to you. Rates vary depending on credit score and loan term. It is the applicable rate for the whole annum. He monthly calculation factors are not considered and rather a single annual percentage factor is calculated.

By keeping other terms equal it is easy to see how apr influences each months payment. Term average apr used. Generally new cars offer lower apr loans while used cars offer a bit higher. Know your credit scores.

How your credit score determines your auto loan apr.