Colorado Car Sales Tax

This means that depending on your location within colorado the total tax you pay can be significantly higher than the 29 state sales tax.

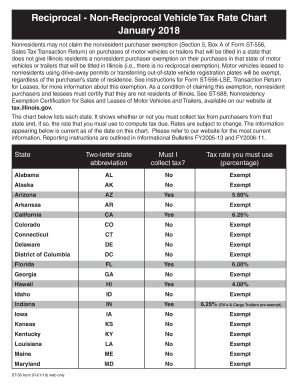

Colorado car sales tax. In general the tax does not apply to sales of services except for those services specifically taxed by law. Municipal governments in colorado are also allowed to collect a local option sales tax that ranges from 0 to 83 across the state with an average local tax of 3298 for a total of 6198 when combined with the state sales tax. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. Leases 1 revised june 2019 under certain circumstances a lease of tangible personal property in colorado is treated as a sale and the lessor must collect sales tax from the lessee on all payments made pursuant to the leasein other cases.

Colorado has a 29 statewide sales tax rate but also has 224 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3298 on top of the state tax. The sales tax return dr 0100 has changed for the 2020 tax year. With local taxes the total sales tax rate is between 2900 and 11200. Motor vehicle dealerships should review the dr 0100 changes for dealerships document in addition to the information on the dr0100 changes web page.

Colorado sales tax 1 revised june 2019 colorado imposes sales tax on retail sales of tangible personal property. Vehicles do not need to be operated in order to be assessed this tax. Although the taxes charged vary according to location the taxes include colorado state tax rtd tax and city tax. Colorado has recent rate changes wed jan 01 2020.

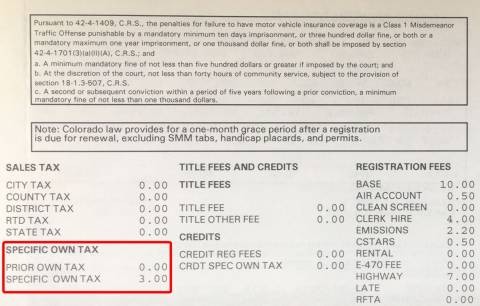

In addition to taxes car purchases in colorado may be subject to other fees like registration title and plate fees. The maximum local tax rate allowed by colorado law is 8. Funding advancement for. Colorado has a statewide sales tax rate of 29 which has been in place since 1935.

The fees that have to be paid along with the taxes are calculated according to the vehicles date of purchase year weight and taxable component. However in the case of a mixed transaction that involves a bundled sale of both tangible personal property and service whether or not such service is specifically taxed. Ownership tax is in lieu of personal property tax. The lessor is required to pay any applicable state and local sales andor use taxes on the lessors acquisition of the property.

You can find these fees further down on the page. Specific ownership tax class tables tax class b tax class c tax class d and tax class f. The ownership tax rate is assessed on the original taxable value and year of service. Taxes and fees.

Colorado co sales tax rates by city. The sales tax is calculated as a certain percentage of the net purchase price of a vehicle. Calculating colorado state auto sales tax. Sales use tax topics.

Provide the colorado certificate of title. If there is more than one owner named on the front of the certificate of title all owners must print and sign their name as seller. The state sales tax rate in colorado is 2900. Select the colorado city from the list of popular cities below to see its current sales tax rate.

To cite an example the total sales tax charged for residents of denver amounts to 772 percent.